Accurate Work Hour Calculation: The Critical Role of Time Rounding

Many businesses invest in tools for payroll, yet still struggle with frustrating inaccuracies. The problem often isn't the final calculation, but the data that feeds it. This guide explores why true accuracy in work hour calculation begins before a calculator is ever touched—it starts with the foundational process of time clock rounding.

The 'Garbage In, Garbage Out' Problem in Payroll

In the world of data, the principle of 'Garbage In, Garbage Out' (GIGO) reigns supreme. If you input flawed or inconsistent data into a system, you will inevitably get flawed or inconsistent results. This is the single biggest challenge in achieving accurate employee time calculation. Even the most advanced payroll software is powerless if the timesheet data is a chaotic mix of unstandarized entries like 8:01 AM, 7:58 AM, and 8:03 AM.

Manually processing these varied times is not only tedious but also a minefield of potential errors. Which employee should be paid from 8:00 AM? Is it fair to penalize someone for being two minutes early or one minute late? Without a standard policy, these decisions become arbitrary, leading to unfairness and compliance risks. This is the core problem that a simple work hour calculator tool alone cannot solve.

Time Clock Rounding: The Foundation of Accurate Payroll

The solution to the data chaos problem is **time clock rounding**. This is the practice of systematically rounding employee punch-in and punch-out times to the nearest, predefined interval (such as 5, 10, or 15 minutes). It is not about docking pay; it is about creating a fair, consistent, and simplified standard for everyone. By applying a neutral rounding policy, you ensure that the data fed into your payroll hour calculation process is clean, uniform, and defensible.

How Rounding Creates Fairness and Efficiency

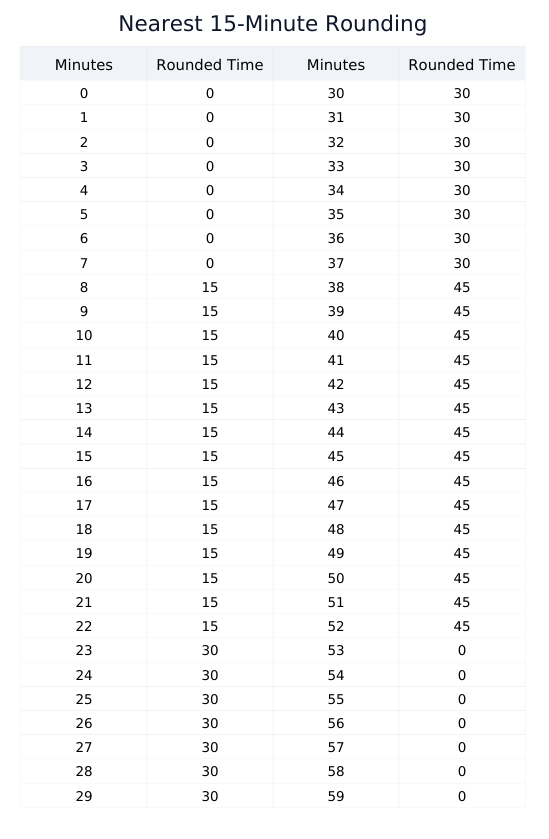

A well-implemented rounding policy, such as the common "7-Minute Rule," ensures neutrality. For example, with 15-minute rounding, clocking in anytime from 8:01 to 8:07 rounds down to 8:00, while clocking in from 8:08 to 8:14 rounds up to 8:15. Since this applies to both clock-ins and clock-outs, it fairly balances out over time and does not systematically benefit the employer or employee.

To ensure your calculations are built on a fair and uniform foundation, it's crucial to understand and apply these principles. You can master this with our interactive Time Clock Rounding Calculator & Guide, which helps you apply the "7-minute rule" and other standards correctly before you even begin calculating work hours.

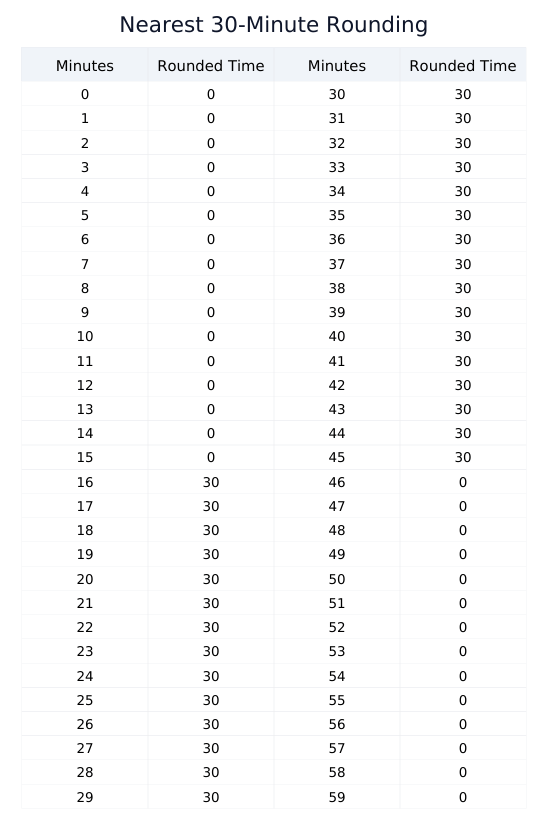

Visualizing the Rounding Rules: Chart Examples

To make these concepts crystal clear, visual charts are invaluable. They provide an at-a-glance reference for how different rounding policies affect time entries. Understanding these charts is the first practical step in ensuring any work time calculate process is built on accurate data. For a convenient offline reference, you can also download a consolidated Time Clock Rounding Rules PDF for Work Hour Calculation Reference. Below are the five most common rounding rules used in business.

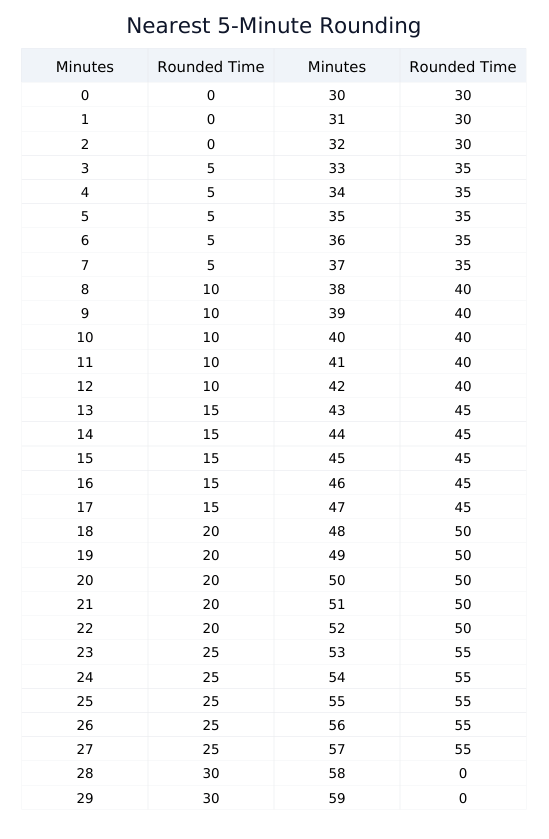

5-Minute Rule Rounding Chart

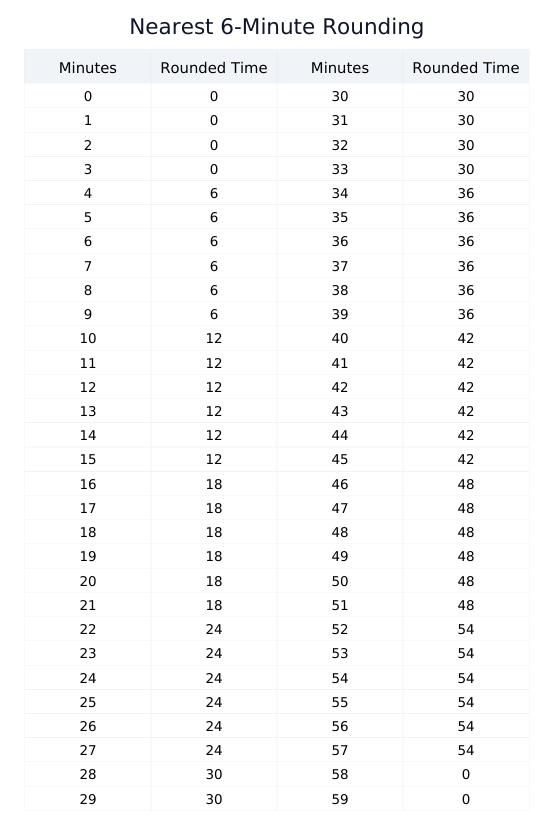

6-Minute Rule (Tenth of an Hour) Rounding Chart

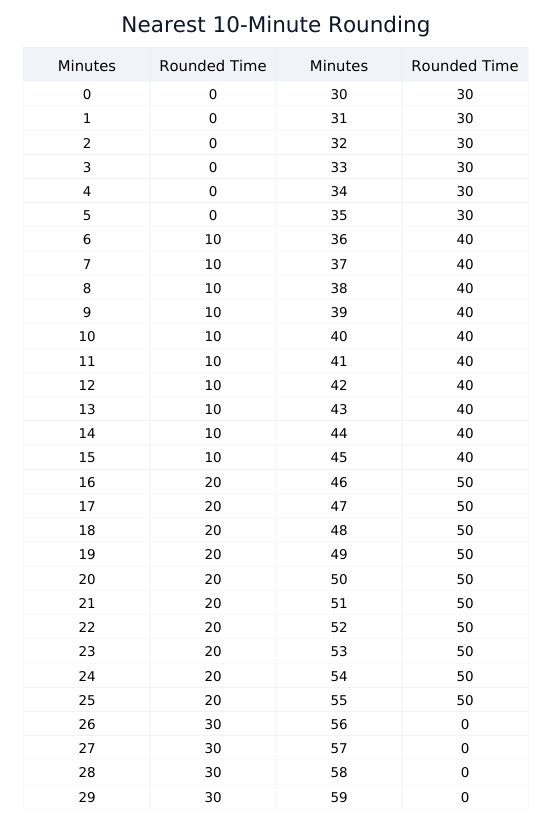

10-Minute Rule Rounding Chart

15-Minute Rule ("Rule of 7") Rounding Chart

30-Minute Rule Rounding Chart

Building a Reliable Workflow for Employee Time Calculation

Thinking of work hour calculation as a workflow rather than a single action is key. A robust process ensures accuracy and compliance at every stage. Here is a proven workflow:

- Capture Raw Punch Times: Use a reliable system to capture the exact time an employee starts and stops work.

- Apply a Standard Rounding Policy: This is the critical step. Process the raw punch times through a consistent rounding rule (e.g., rounding to the nearest quarter-hour). This normalizes the data.

- Calculate Gross Duration: Subtract the rounded start time from the rounded end time.

- Deduct Unpaid Breaks: Subtract any unpaid break periods (e.g., a 30 or 60-minute lunch) to get the final number of hours worked.

- Convert to Decimal Format: For payroll, convert the final time into decimal hours (e.g., 7 hours and 45 minutes becomes 7.75 hours). This is the format that payroll systems use for monetary calculations.

A good work hour calculator tool can automate steps 3-5, but only after you have correctly completed step 2. The integrity of the entire process hinges on the quality of the rounding policy.

Handling "Just a Few Minutes": A Risky Gamble vs. a Smart Policy

Beyond simple fairness, a primary driver for precise employee time calculation is maintaining trust and accountability. It's a widely accepted business principle that employees should be compensated for all time they spend on work-related activities. Consistently failing to account for small increments of time, such as tasks performed shortly before or after official shifts, can lead to disputes and erode employee morale.

Some managers might be tempted to ignore these small increments, thinking of them as too minor to matter. However, relying on this informal approach for regular, daily occurrences is a risky gamble. These 'few minutes' add up, and employees will notice if their time isn't being valued. A formal, consistently applied time rounding policy is a far more robust and transparent strategy. It provides a clear, predictable system for handling all time worked, demonstrating good faith and ensuring your payroll hour calculation is both fair and defensible.

From Payroll to Strategy: The BI Value of Accurate Time Data

Viewing accurate work hour calculation solely as a payroll function is a missed opportunity. When standardized through proper time rounding, your time data transforms from an administrative headache into a valuable source of Business Intelligence (BI).

With clean, reliable data, you can perform much deeper analysis. For example, you can conduct precise project costing to understand profitability, identify which teams or tasks are consistently requiring overtime, and gain insights into workforce productivity. This data-driven approach to management, which is only possible with an accurate system for calculating work hours, allows for smarter scheduling, better resource allocation, and proactive identification of operational bottlenecks.

What to Look For in a Time Calculation System

When evaluating tools to support your employee time calculation process, think beyond a simple calculator. Look for a system or a set of tools that supports the entire workflow.

The easiest way to see the full pipeline in action is to model a week inside our Time Card Calculator, then verify the rounding behavior separately in this guide.

- Support for Rounding Rules: Does the system allow you to define and automatically apply your company's rounding policy?

- Break Management: Can it handle both paid and unpaid breaks automatically?

- Overtime Calculation: The system should automatically identify and calculate overtime based on your local labor laws (e.g., time-and-a-half over 40 hours).

- Decimal Conversion: It must flawlessly convert time to decimal hours for payroll integration.

- Audit Trails: A great system stores both the original, un-rounded punch times and the final rounded times. This transparency is crucial for compliance and resolving any pay disputes.

Conclusion: Accuracy is a Process, Not Just a Tool

Ultimately, achieving perfectly accurate work hour calculation is not about finding a magic calculator. It is about implementing a robust, end-to-end process. The most critical and often-overlooked stage of this process is standardizing your input data through a fair and consistent time clock rounding policy.

By focusing on the quality of your data first, you empower your team, ensure compliance, and make your entire payroll process more efficient and trustworthy. A work hour calculator is an essential part of the machine, but time rounding is the fuel that makes it run accurately.